The following information is required when setting up a new start. Accounting period basis period for a Labuan entity is 01022020 31012021.

Request for Taxpayer Identification Number TIN and Certification Form 4506-T.

. Employees Withholding Certificate. This form can be downloaded and submitted to Lembaga Hasil Dalam Negeri Malaysia. MTD is a mechanism where the employer deducts the employees salary on a.

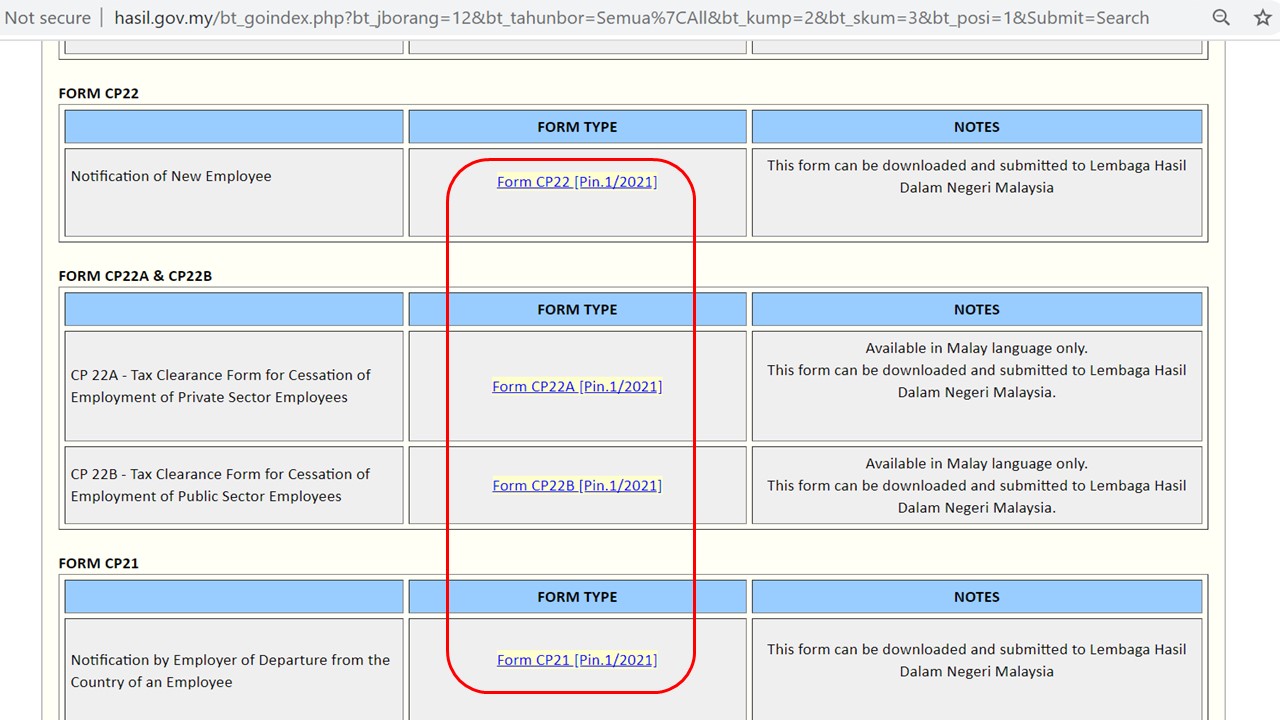

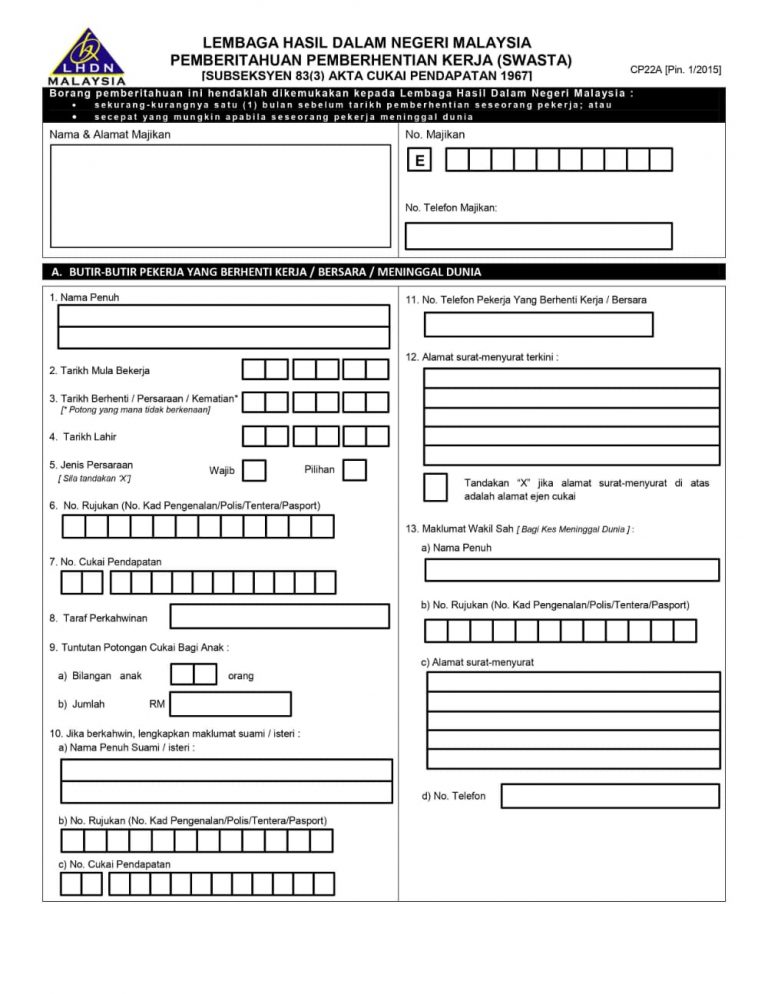

Malaysian Taxation on Foreign-Sourced Income. Employers must use Digital Certificate e-filing for access to e-SPC. Form CP22A Tax Clearance Form for Cessation of Employment of Private Sector Employees.

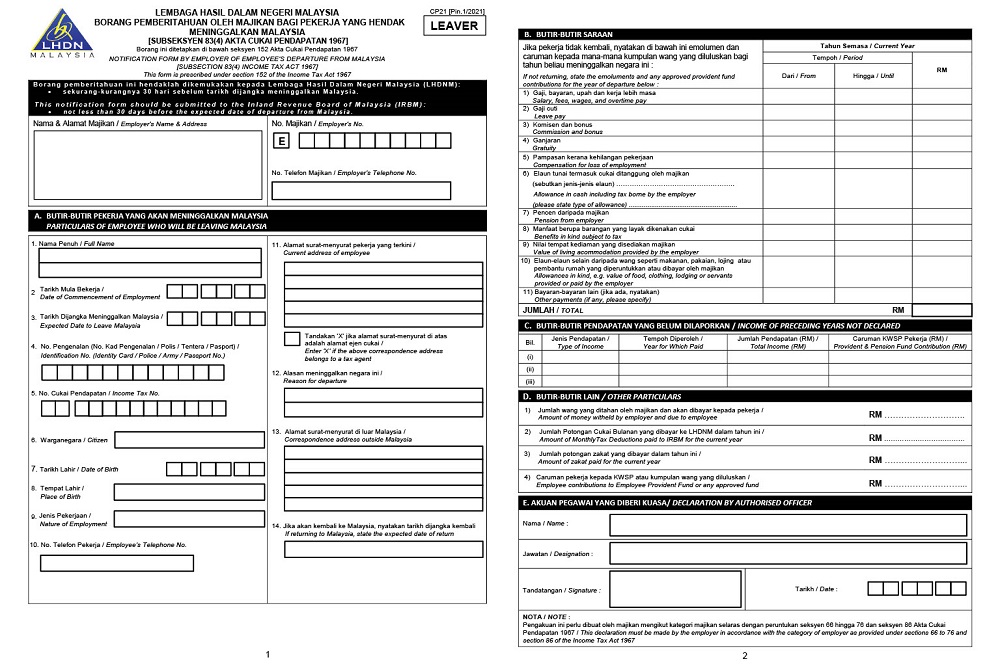

Dismissal via form CP22A CP22B and CP21 notice for workers who wants to leave the country. The due date for submission of Form LE3 for Year of Assessment 2022 Year of Assessment 2021 under the ITA 1967 is on 30042020. This system was developed in web applications and users can access the system through the website httpsezhasilgovmy 2.

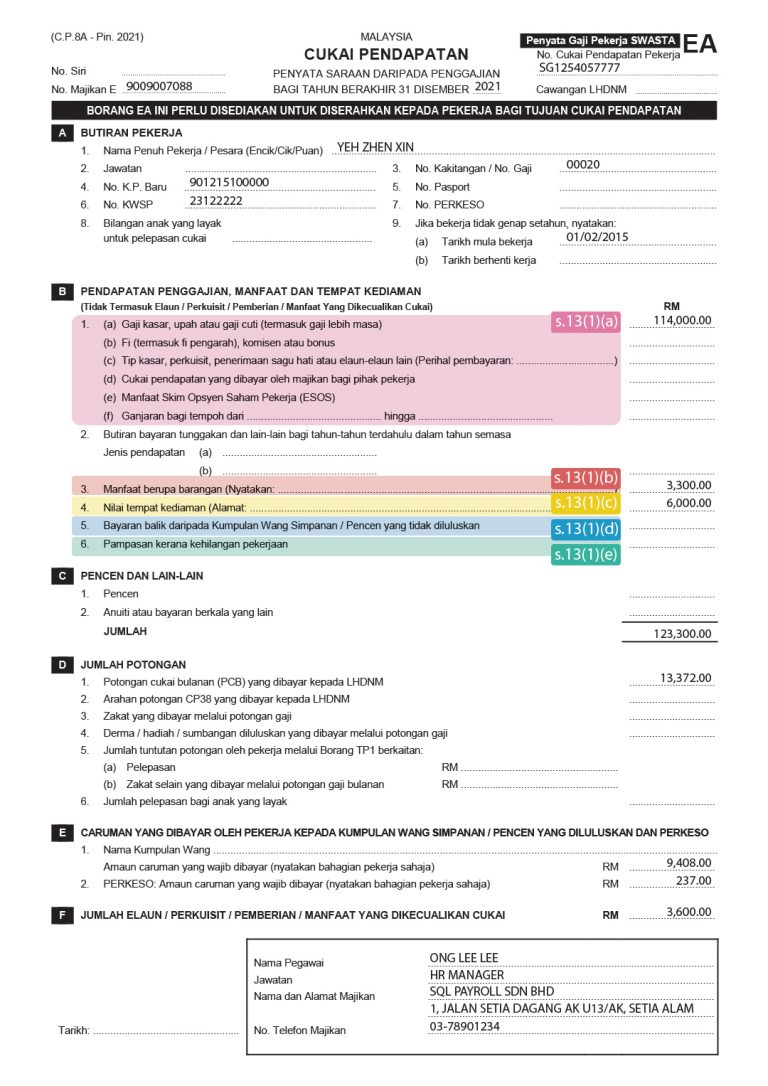

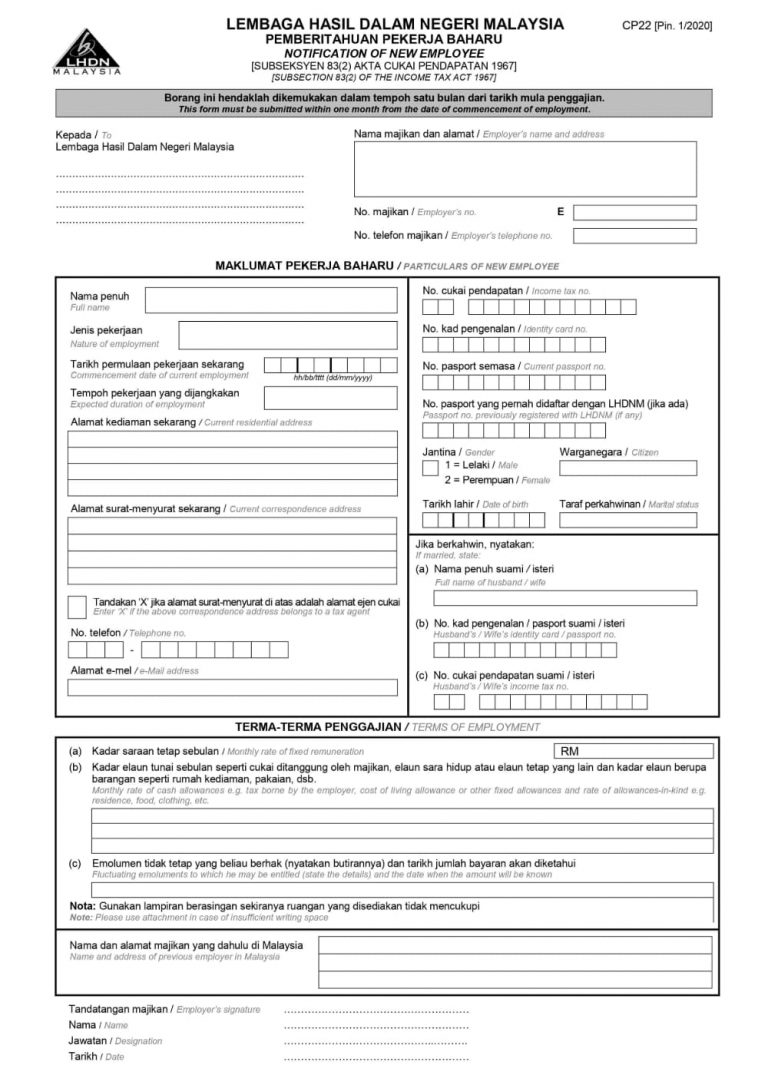

A copy of Identity Card. The Malay version is a translation of the original text in English for information purposes only. To set up a new employee the employer must submit SOCSO Form 2 Form EIS 2A and Form CP22 to inform SOCSO EIS and Inland Revenue Board IRB on the new hire.

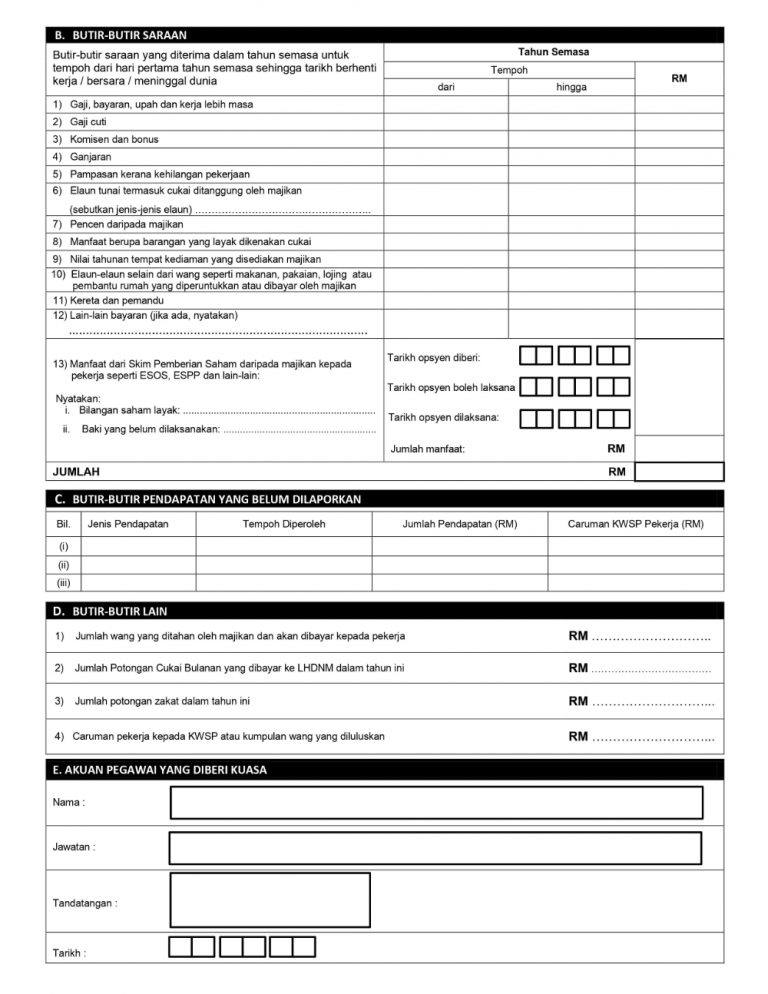

CP 22A - Tax Clearance Form for Cessation of Employment of Private Sector Employees Form CP22A Pin12021 Available in Malay language only. Form E will only be considered complete if CP8D is submitted within the stipulated deadline. Versi Bahasa Melayu adalah terjemahan dari teks asal dalam Bahasa Inggeris untuk tujuan maklumat sahaja.

Guideline for Personal Tax Clearance Form CP21 CP22A CP22B. Form LE3 for Year of Assessment 2021 Year of Assessment 2020 under the ITA 1967 is on 31032020. Melayu Malaysia MYTAX Content.

3Submit return form of employer Form E together with the CP8D on or before 31 March of the following year. Request for Transcript of Tax Return Form W-4. Treasury Inspector General for Tax Administration.

SUBMISSION AND MONTHLY TAX DEDUCTION MTD PAYMENT. In case of any discrepancies the original language in English will prevail. Real Property Gains Tax RPGT in Malaysia.

Employer company and Labuan company is compulsory to submit Form E via e-Filing e-E with effect from remuneration for the year 2016. Sekiranya berlaku sebarang percanggahan bahasa asal dalam Bahasa. Criteria on Incomplete Form CP21 CP22 CP22A and CP22B Which is Unacceptable.

TP3 if employed in Malaysia within commencing year. Instructions for Form 1040 Form W-9. In case of any discrepancies the original language in English will prevail.

Pcb Tp1 1 2021 New Form Format Otosection

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

Guideline For Personal Tax Clearance Form Cp21 Cp22a Cp22b

1 Borang Cp22a Pdf Course Hero

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Cp22 Cp22a Cp21 Sql Payroll Youtube

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Cp 21 Cp22 Cp22a Cp22b Lhdn Dec 29 2021 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Download Your Personal Tax Clearance Letter Cp22 Cp22a